Sector Update / Consumer Discretionary / Click here for full PDF version

Author(s): Lukito Supriadi ;Andrianto Saputra

- We expect and to continue their strong 4Q23 trend into 1Q24F boosted by favorable base-effect and shift of Lebaran.

- On the other hand, we note the high base effect for /LPPF as 1Q23's SSSG of 18/10% may imply a more muted growth in 1Q24F.

- and have the highest exposure to US$-related merchandise imports but Rp weakness shall be manageable for them.

FY23 & 4Q23 recap: diverging mid-up and mid-low retailers' trend

In FY23, mid-up retailers (/ACES) along with booked +14.9% yoy aggregate earnings growth. On the other hand, it was /RALS's -51.2/-14.7% yoy earnings decline that dragged retailer's aggregate earnings to be flattish at 0.4% yoy. and over delivered (Fig. 2 & 6) - for its performance was due to better-than-expected SSSG of 8.1% (vs. target of 6.5%) and cost control; whereas was due to strong GPM achievement at 21.6% (+92bps yoy) which reflects its bargaining power toward FMCG suppliers. 4Q23's aggregate earnings declined -13.5% yoy weighed down by the reversal of employee benefit expenses reduction in 4Q22.

Expecting strong 1Q24F performance for and

Looking into 1Q24F, we expect to continue its strong yoy performance partly on the back of favourable base effect. 2M24 SSSG has registered 10.0% yoy and we expect Mar24F SSSG to sustain its double digit trajectory. Similarly, is likely to see a strong 1Q24F as the FMCG sales for Lebaran seasonality was brought forward by ten days from last year. We expect to register a high single-digit SSSG in 1Q24F. Coupled with 's 1Q24 SSSG of 13.7%, this may indicate an improving top-line growth for consumer staples in general - possibly boosted by election spending.

Managing expectations for and in 1Q24F

On the other hand, we are managing our expectations for /LPPF with low single digit/flattish 1Q24F SSSG due to 1Q23's high base effect. Recall /LPPF's 1Q23 SSSG stood at 18/10%, partly driven by the pent up demand during the pandemic-endemic transition. has recently revised its FY24F sales growth guidance to >20%, from previously >25% on a more conservative store expansion target this year. Additionally, our channel checks suggest that 's F&B arm () have yet to fully recover from the boycott impact. contributes 12.9/6.9% to 's revenue/EBIT in 9M23 (pre-boycott).

Assessing dollar exposure among retailers

In light of the Rupiah weakness (USDIDR has breached Rp16k), we analysed retailers' costs exposure to US$. In Fig. 3, we highlight that and import the majority of their merchandise. Although merchandise is sourced mostly from China and SE Asia, a significant portion of the transactions are denominated in US$ when dealing with principals. Despite the Rupiah weakness, we note that and shall be able to pass on cost increments to their mid-upper target consumers.

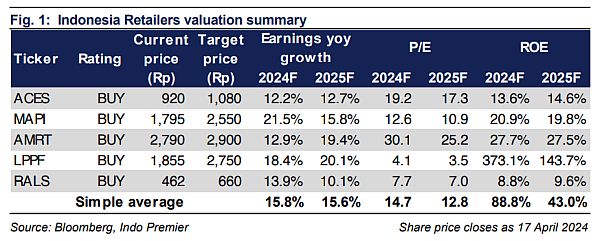

Maintain sector Neutral with preference for

We continue to prefer mid-up targeting retailers over mid-low retailers. Institutional ownership trend remains largely similar with investors being well-positioned in /ACES/MAPI. In conclusion, we maintain our Neutral stance for the sector on lack of positive catalysts. Our pecking order is as follow: > > > > .

Sumber : IPS

powered by: IPOTNEWS.COM